Roth ira withdrawal penalty calculator

Ready To Turn Your Savings Into Income. If you satisfy the.

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Roth IRA Withdrawal Penalty Calculator.

. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to. Some exceptions allow an individual younger than 59½ to. Before making a Roth IRA withdrawal keep in mind the following.

Penalties for those under age 59½ who. Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings. Ad You Can Manage Your Own IRA or TIAAs Investment Professionals Can Help You.

Automated Investing With Tax-Smart Withdrawals. As an example lets say that youre 35 years old. That is it will show which amounts will be subject to ordinary income tax andor.

Roth IRA Distribution Tool. If you have a 401k or other retirement plan at work. Buy Gold Investments from Top US Providers.

You can contribute up to 20500 in 2022 with an additional 6500 as a. Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture. Get Up To 600 When Funding A New IRA.

Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on. Similar to so many things in life theres. Ad You Can Manage Your Own IRA or TIAAs Investment Professionals Can Help You.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Do Your Investments Align with Your Goals. This is a penalty on the entire distribution.

The calculator will estimate the monthly payout from your Roth IRA in retirement. Wed suggest using that as your primary retirement account. Get Up To 600 When Funding A New IRA.

It allowed withdrawals of up to 100000 from traditional or Roth 401 k for 2020 only without the 10 penalty for those under age 59½. Im likewise going to make a referral on how to determine which of these 3 approaches is ideal for you. Reviews Trusted by Over 45000000.

In this example multiply 2500 by 01 to. Roth IRA Distribution Details. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are.

Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture. In some situations an early withdrawal may also be subject to income. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA.

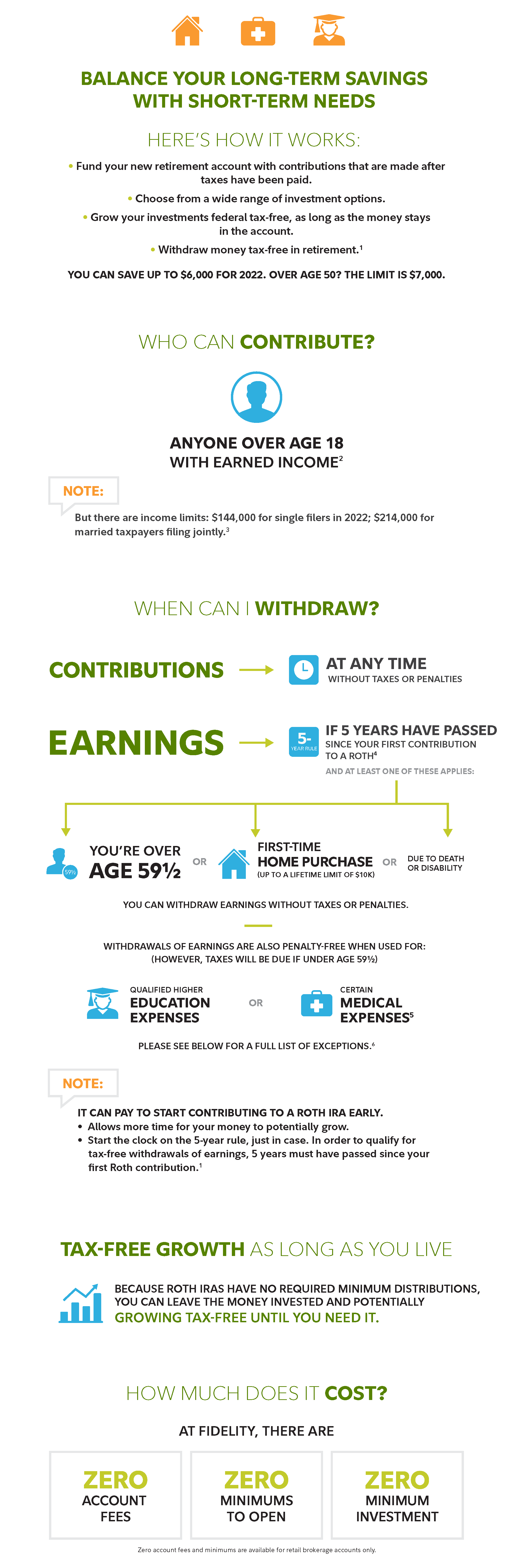

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Explore Choices For Your IRA Now. You cannot deduct contributions to a Roth IRA.

Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. Find a Dedicated Financial Advisor Now. Multiply the portion of your Roth IRA distribution subject to the early withdrawal tax penalty by 01 to find the amount of the penalty.

A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA. Presuming youre not around to retire next year you desire development and focused investments for your Roth IRA. Lets talk concerning the.

When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Roth IRA Early Withdrawal Penalty Calculator.

This tool is intended to show the tax treatment of distributions from a Roth IRA. Ad Explore Your Choices For Your IRA. If you withdraw contributions before the five-year period is over you might have to pay a 10 Roth IRA early withdrawal penalty.

Direct contributions can be withdrawn tax-free and penalty-free anytime. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. This condition is satisfied if five years have.

First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

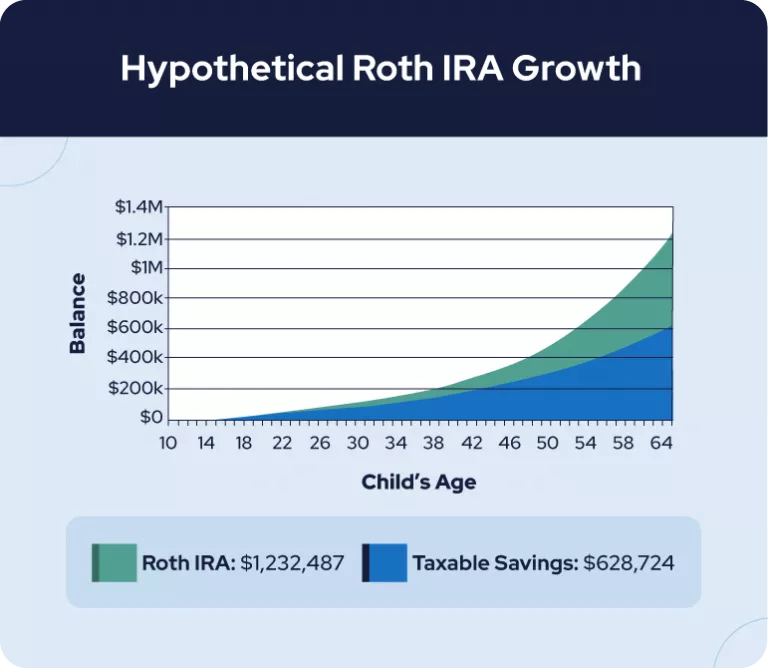

Roth Ira For Kids Rules And Contributions Shared Economy Tax

Pin On Financial Independence App

Save For The Future With A Roth Ira Fidelity

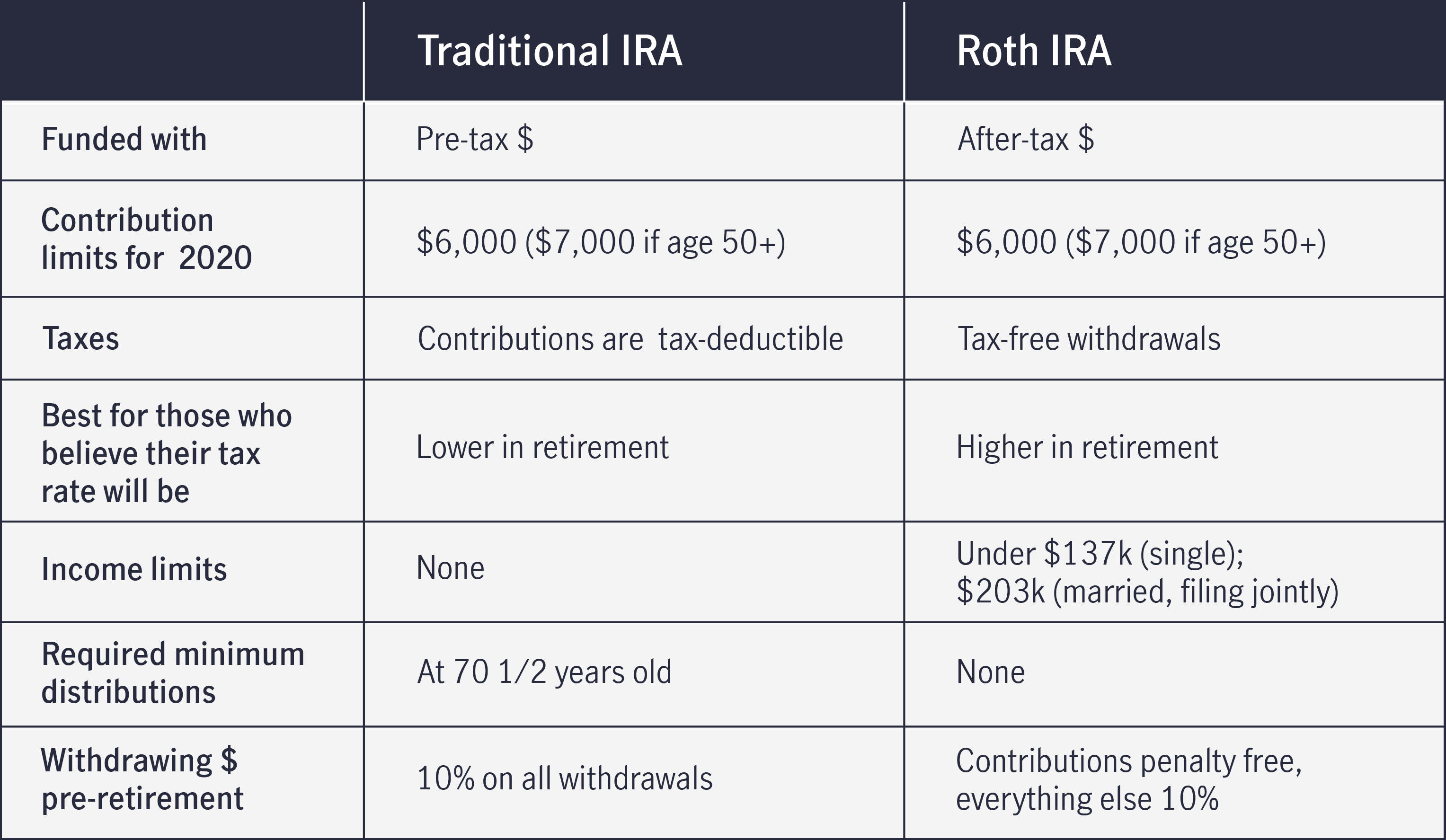

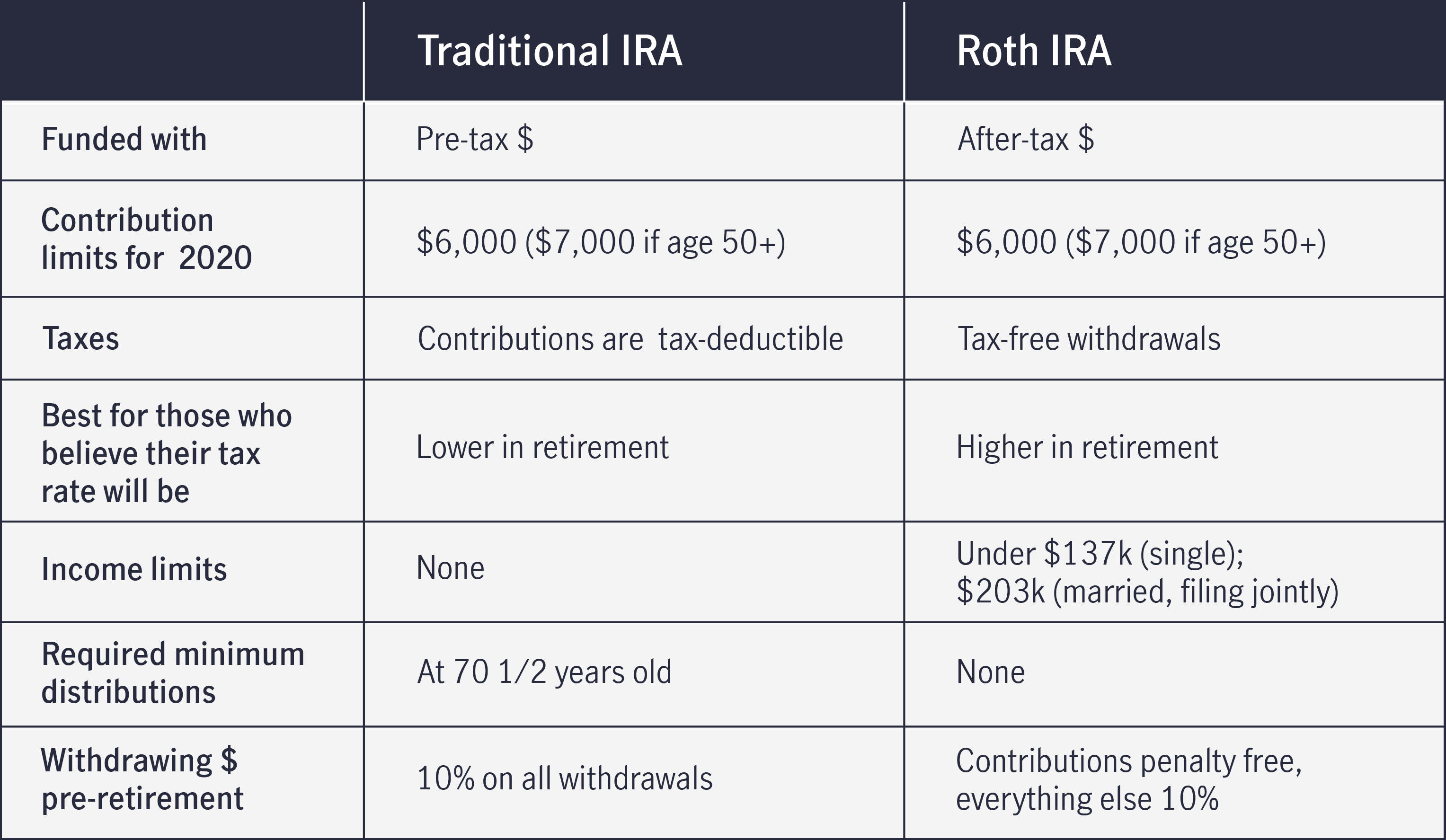

Comparing Traditional Iras Vs Roth Iras John Hancock

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Roth Vs Traditional Ira Key Differences Comparison

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator